- #Apply for paypal credit how to

- #Apply for paypal credit full

- #Apply for paypal credit password

- #Apply for paypal credit zip

You must designate your credit as your primary payment option to use your credit for in-store purchases. If your application is successful, select Continue to return to your PayPal account. However, this does not imply that you can default on your payments, as repeated missed payments could lead to account closure and accrual of late fees. Conversely, consistently paying on time will not boost your score either. This implies that your credit score will be fine with missed payments. PayPal credit operates differently from traditional credit providers as they do not inform credit bureaus of your positive or negative payment behavior after approval. To approve your application, PayPal will check your credit score as banks do before issuing a loan. Step 8: Wait For ConfirmationĪfter submitting your application, PayPal will respond to your eligibility for a credit line in less than a minute. Click Agree and Apply when prompted.īy doing so, PayPal will initiate the process of assessing whether you qualify for PayPal Credit. Although the terms of use can be lengthy and unremarkable, it’s vital to stay informed about any modifications PayPal has made to the PayPal Credit conditions. It’s essential to read through the terms of use carefully. If you don’t own a mobile phone, select the Mobile option and choose Home before providing your home phone number. Enter your name, date of birth, and other details. To complete the necessary fields on this page, fill in your date, month, birth year, social security number, and phone number.

#Apply for paypal credit zip

To provide a billing address, fill out the form on the left side of the page with your preferred street address, city, state, and ZIP code.

#Apply for paypal credit password

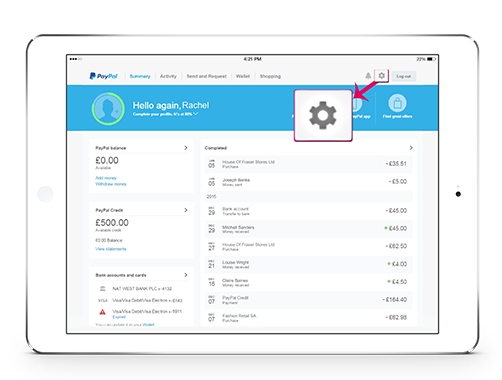

To access your PayPal account, enter your email address and password in the fields provided, then click on the Log In button to proceed. © Step 4: Sign Into Your Account Enter your email/phone number and password.

#Apply for paypal credit full

However, if you fail to settle the full credit balance within the 6-month timeframe, PayPal credit will apply 6 months’ interest on the purchase. You could delay making payments for up to 6 months without incurring interest or fees. To comply with PayPal credit’s 6-month rule, you can avoid interest charges on purchases that cost more than $99 if you pay them off within 6 months. PayPal provides a set of offer details that you must read and understand before you continue. © Step 3: Read the Details of the Credit Agreement Navigate to PayPal Credit and Cards.įrom the drop-down menu, select PayPal credit and click on apply. To apply for PayPal credit, go to the PayPal website and click “Personal” at the top of the page. For quick approval, ensure your credit history is good. Once you have set up an account, you can apply for PayPal credit. However, if you want to change, the drop-down arrow will allow you to do so. The billing address will automatically pick what you had filled in your personal information. Select the card type, and fill in the card number, expiration date, and security code. Once your account is ready, link it with a debit or credit card, then use it to shop or send money. The good thing is that you can create a PayPal account for free.

To access the PayPal credit function, you must create a PayPal account. In this guide, we’ll explore everything you need to know about using PayPal credit and how it can help enhance your online shopping experience. Nevertheless, there are several benefits to using PayPal credit, especially if you frequently shop online and already have a PayPal account.

#Apply for paypal credit how to

Sadly, some users do not know how to use the PayPal credit option.Īs a fully online-based service, PayPal credit differs from other credit cards bearing the PayPal name, such as the PayPal Cashback Mastercard. However, unlike traditional credit cards, PayPal credit can only be used online and does not come with a physical card. While we often think of Visa, MasterCard, and American Express as the go-to credit card brands, PayPal is also a player in the credit business.

PayPal has become synonymous with e-commerce and online banking, offering one of the safest ways to make online transactions.

0 kommentar(er)

0 kommentar(er)